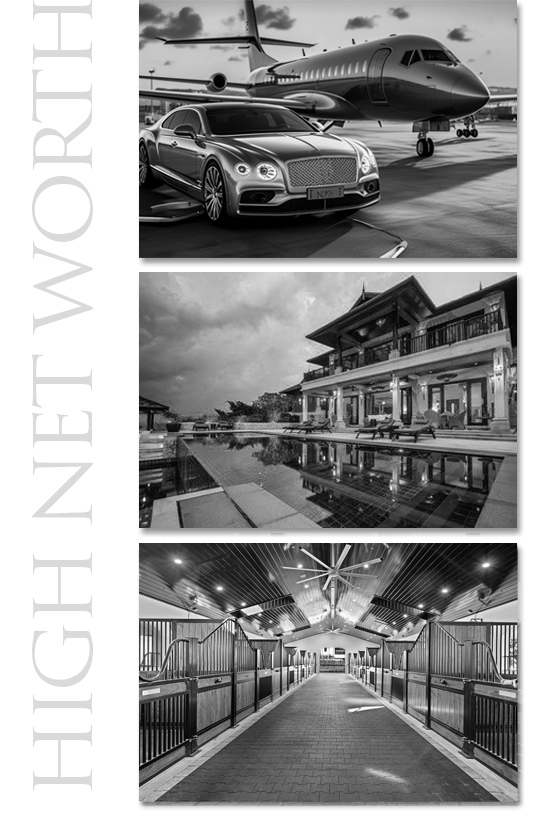

What exactly IS

Private Client Insurance?

Private client insurance, also known as high net worth (HNW) insurance, is a specialized type of insurance designed to provide comprehensive and tailored coverage for individuals or families with significant assets, properties, and valuable possessions. This type of insurance goes beyond standard insurance policies to address the unique and often complex needs of wealthy individuals. Private client insurance typically includes coverage for a wide range of assets, including homes, automobiles, jewelry, art, antiques, collectibles, yachts, and more.

Key features of private client insurance include:

- High Coverage Limits: Private client insurance policies offer higher coverage limits than standard insurance policies. This ensures that valuable assets are adequately protected in case of loss, damage, or liability.

- Customized Coverage: Policies are tailored to the specific needs and preferences of the insured individual or family. This might involve insuring unique items, addressing specific risks, and accommodating individual circumstances.

- Agreed Value Coverage: Many private client policies use an “agreed value” approach, where the insured and the insurer agree on the value of an item upfront. In the event of a covered loss, the agreed value is paid out without depreciation considerations.

- Broad Coverage: Private client insurance often includes broader coverage options that might not be available in standard policies. This could include coverage for risks like identity theft, travel insurance, liability coverage for domestic staff, and more.

- Risk Management Services: Insurance companies offering private client coverage often provide risk management services. This might involve security assessments, recommendations for safeguarding valuable items, and advice on minimizing risks.

- Personalized Service: Insurers that specialize in private client insurance typically offer personalized service and dedicated account managers who understand the unique needs of high net worth individuals.

- Loss Prevention Assistance: Some policies include resources to help prevent losses, such as providing guidance on security measures for homes and valuable items.

Private client insurance is essential for protecting substantial assets and maintaining financial security for affluent individuals and families. Because of the complexity involved in assessing and insuring high-value assets, it’s recommended to work with insurance providers that specialize in this type of coverage. These providers often have expertise in evaluating the value of unique items, understanding the risks associated with high net worth lifestyles, and crafting policies that offer comprehensive protection.